ClimateMAPS generates forward-looking risk-return analytics to map a portfolio’s exposure to climate risk and opportunities. The solution is independent and distinctive, has comprehensive risk coverage and is customizable to client-specific assumptions. It can be widely utilized by financial institutions, ranging from investigating the financial impacts of different climate pathways to reporting to stakeholders in line with TCFD recommendations.

is independent and distinctive

has comprehensive risk coverage

is customizable to client-specific assumptions

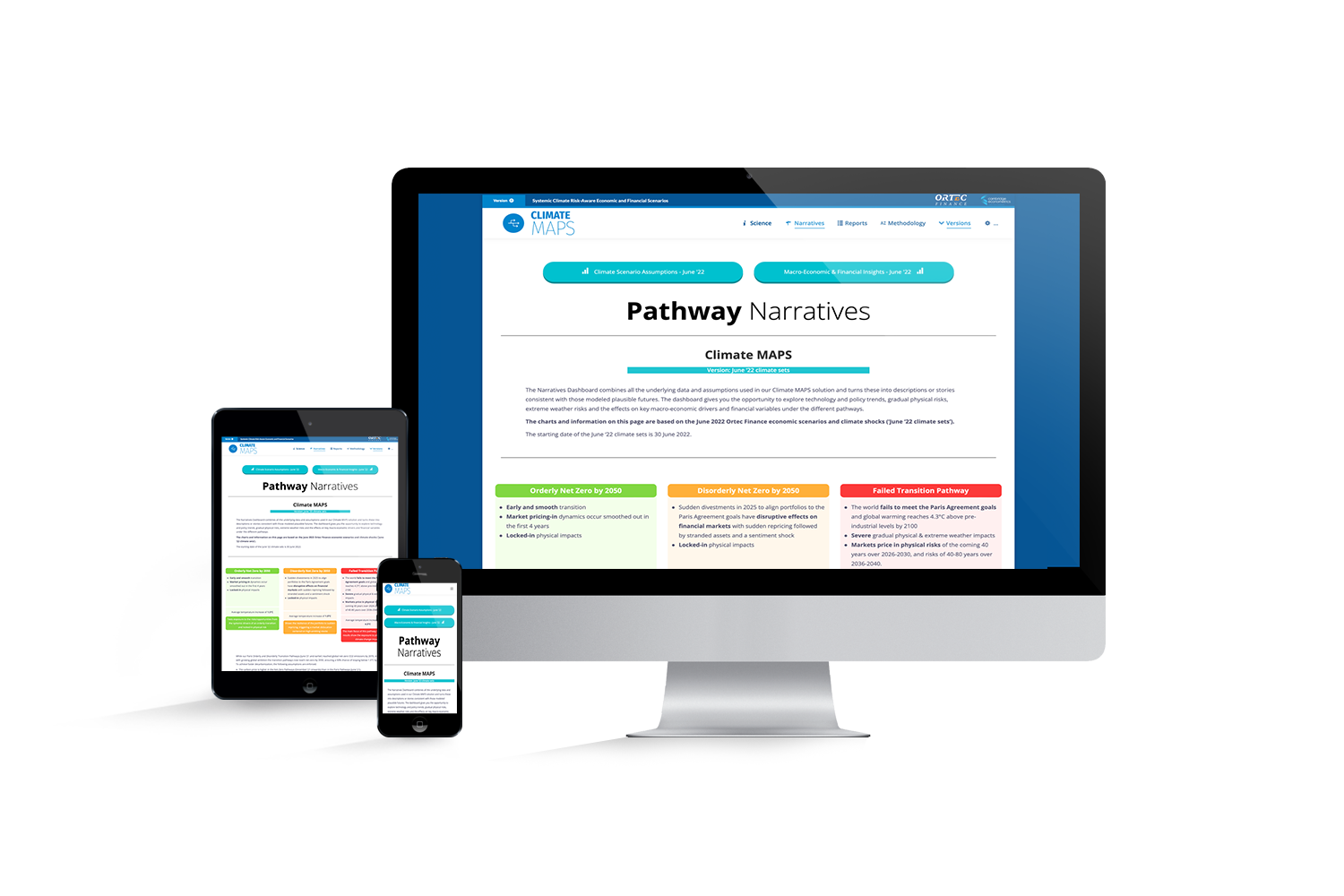

The Pathway report enables you to view technology trends, policy measures, gradual physical risks & climate-related extreme weather events per global warming pathway. It then sets out how these climate risks impact key economic and financial risk drivers.

-

Net-Zero

-

Net-Zero financial crisis

- Limited action

- High warming

The Compass

Climate & ESG Solutions

Navigate a changing climate with a suite of complementary solutions

that integrate climate risk and opportunities into investment decision-making.

Ortec Finance’s Climate & ESG Solutions offers ‘The Compass’ alongside hands-on expertise to enable investors to effectively integrate climate risks and opportunities into their investment decision-making.

Comprising of ClimateALIGN, ClimateMAPS, ClimatePREDICT and ClimateSIGNS, The Compass generates quantified metrics and insights through independent and research-based climate knowledge, advanced models and innovative technology. Its customizable analytics help financial institutions measure, manage and monitor their climate strategy.

All four solutions consistently use the same climate scenarios and deliver customizable analytics to help financial institutions measure, manage and monitor their climate strategy.

The solutions are designed to be software integration-friendly, customizable and allow for individual implementation or client-specific tailored combinations.

Assesses real assets’ exposure to extreme weather risk under distinctive climate scenarios.